March 6, 2024

Introduction

Over the past decade, Thailand emerged as a major ethanol producer thanks to strong government support and rising domestic fuel consumption. However, after years of growth, the ethanol industry is now in a difficult position, facing several challenges even as the landscape of Thailand’s vehicle market undergoes transformative change.

The Boom Years

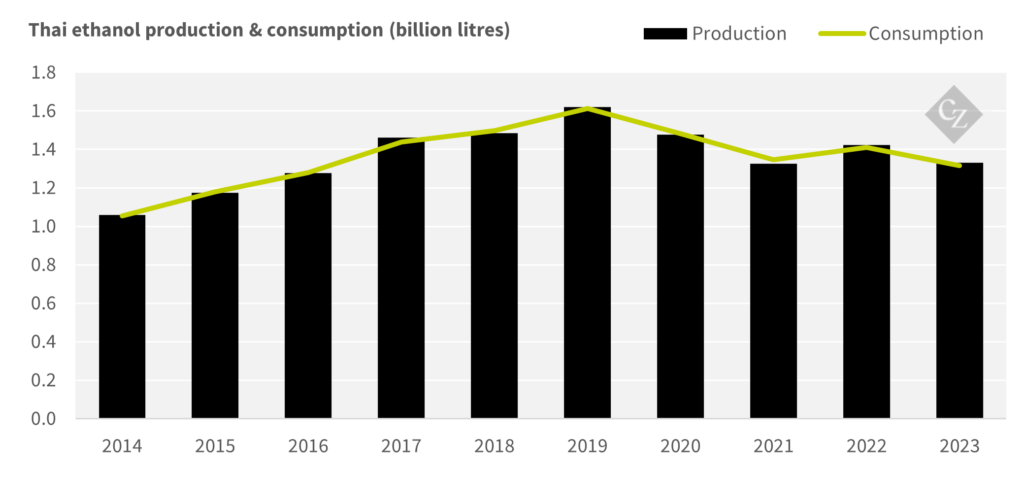

Ethanol production in Thailand increased rapidly from 1.05 billion liters in 2014 to a peak of 1.61 billion liters in 2019. The number of distilleries rose quickly during this period, concentrated around the sugarcane and cassava cultivating regions which provided ready feedstock.

The growth was driven by Thailand’s Alternative Energy Development Plan which aimed to increase consumption of renewable fuels. The government provided supportive incentives like soft loans for feedstock cultivators, guarantees on crop prices, and subsidies for ethanol producers.

Tight control was maintained on imports through quotas and high tariffs to protect domestic production. The state oil company, PTT, was mandated to purchase all domestically produced ethanol for blending with gasoline. These measures stimulated massive investments in distilleries and feedstock cultivation.

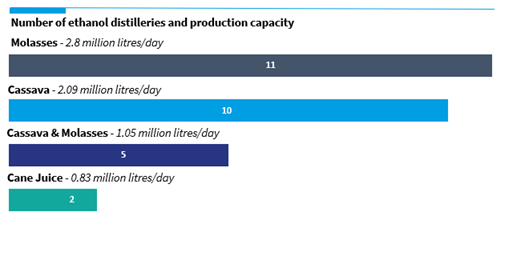

By 2019, Thailand had 28 distilleries with a total production capacity of 2.47 billion liters per year. The top producers were companies like KTIS, Mitrphol, Biofuel and KSL. Sugarcane and cassava yields increased substantially through the infusion of technology and mechanization.

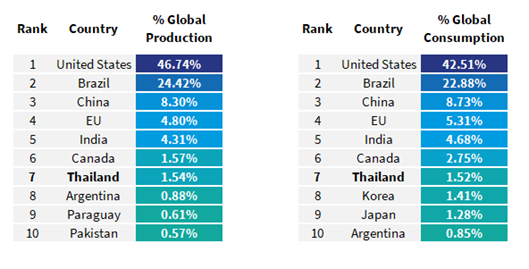

Gasoline with ethanol blended (gasohol) accounted for over 97% of all transport fuel. Several blends of gasohol were available, E10, E20 and E85. E10 dominated consumption, but the government looked poised to drop E10 in favour of E20, which would have further increased consumption. Thailand emerged as the 7th largest producer and consumer of ethanol globally during the boom years.

With consumption peaking at 1.61 billion liters, investments flowing in, and plans to further increase blending targets, the future appeared bright.

Factors Behind the Decline

However, since 2020, ethanol consumption has dropped by 19% to around 1.3 billion liters annually. There are several factors that have contributed to this decline:

- Feedstock Supply Issues: Ethanol production in Thailand relies heavily on domestic feedstocks like sugarcane and cassava. But crop yields have been impacted by drought and floods caused by El Nino weather patterns in recent years. This led to lower feedstock availability and higher prices, raising production costs.

- High Production Costs: Low feedstock supply has lifted feedstock prices, increasing Thai ethanol production costs. They are now higher compared to other major producers in the region like Vietnam, Pakistan and India where corn is used as feedstock.

- Inadequate Storage Infrastructure: Most ethanol distilleries lack adequate storage capacity to stockpile feedstock and ethanol inventories for extended periods. This makes them vulnerable to feedstock shortages during adverse weather events. The lack of storage and ability to manage working capital needs drove up costs.

- Inflexible Policies: Restrictions on ethanol imports and exports reduced flexibility in managing supply fluctuations. Mandates to procure all domestic production forced the use of costlier ethanol during shortages. Delays in securing regulatory approval for alternative feedstocks like corn further eroded competitiveness. Moves to drop E10 in favour of E20 have been repeatedly postponed.

- Market Uncertainty: Future ethanol demand growth in Thailand remains uncertain. This has discouraged investments in expanding capacity among incumbents as well as new entrants. Producers are apprehensive about returns on major capacity enhancements.

These factors led to the decline in consumption and capacity utilization. Addressing the structural challenges is vital for the Thai ethanol industry to regain its growth momentum.

Rise of Electric Vehicles – An Existential Threat?

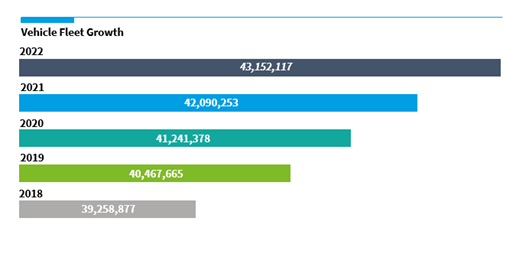

As incomes rose over the past decade, vehicle ownership in Thailand increased at an average annual rate of 2.3%. The total number of registered vehicles increased from 30 million in 2018 to 35 million by 2022. However, the government has set ambitious goals for electric vehicle (EV) adoption, targeting EVs to reach 30% of new car sales by 2030.

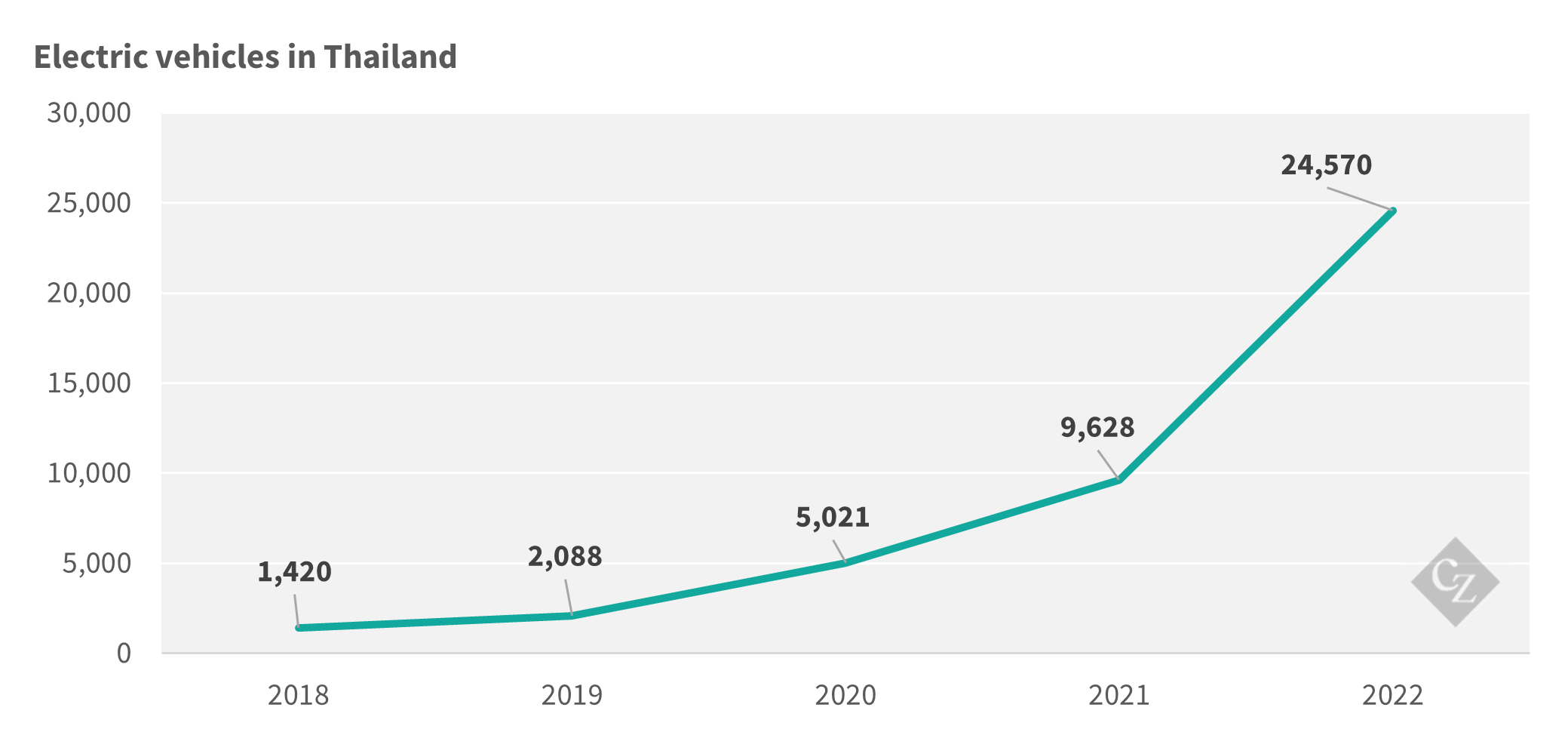

Registrations of new EVs are rising fast, jumping from 1,420 in 2018 to 24,570 in 2022. But EVs still comprise only around 2% of new car sales as of 2022. Achieving the 30% target by 2030 will require a massive policy push and change in consumer mindsets.

For the ethanol industry, the EV goals spell uncertainty. Ethanol relies heavily on a captive gasoline-vehicle fleet for its main use as a fuel blend. But if EVs achieve high penetration by 2030, it would substantially erode gasoline and ethanol fuel demand.

Without the ability to export or find alternative markets, Thailand’s complete dependence on domestic ethanol production leaves it highly vulnerable to declining fuel use.

While the 2030 EV target still appears over-ambitious, the government’s decisive EV policy direction is worrying for ethanol producers.

Pivoting to Survive

Liberalising the ethanol market rules in Thailand is the key to the industry’s survival. The industry also needs to proactively seek new opportunities. Ending restrictions on ethanol exports and diversifying into new sectors like sustainable aviation fuel, industrial alcohol, and bioplastics could help producers absorb spare capacity.

Sustainable Aviation Fuel (SAF) is poised to take off in Thailand with the government mandating its blending in jet fuel starting 2025. As a feedstock, ethanol can help meet the initial 1% blending target and higher future requirements. Companies like Bangchak are already developing SAF production capabilities.

Industrial alcohol has applications in the pharma, cosmetics, sanitizer, and chemical industries. Freeing up ethanol supplies for these sectors can offset reduced fuel ethanol demand. Leading producers have been lobbying the government for policy changes to enable diversion of ethanol for industrial alcohol production.

Bioplastics such as bio-polyethylene and PEF made from ethanol offer exciting new avenues. Major manufacturer KTIS is already pursuing this route, developing bio-plastics for food packaging and other applications. Others can emulate this pivot to bioplastics as well.

However, producers need to act swiftly before the window of opportunity closes. The recent Economic Ministers Meeting approved allowing ethanol exports of 1 million liters annually initially. While a small start, this signals a policy shift that producers can capitalize on.

Establishing the infrastructure and customer relationships to supply these new sectors will take time and investment. Producers will also need to enhance efficiency to remain competitive. Government support during this transition will be essential. Thailand’s ethanol industry will need strategic vision and bold reinvention to claim a place in the economy of the future. Companies that act decisively have a chance to turn uncertainty into opportunity. Navigating this process will require deep market insights and strategic foresight.

Our team of experts has been closely monitoring the Thai ethanol industry for over a decade. We understand the complex interplay of feedstock markets, government regulations, consumer preferences, and emergent technologies that will shape the future growth and profitability of ethanol. Whether you are an investor looking to deploy capital, a producer exploring new verticals, or a policymaker weighing reforms, we can provide actionable intelligence and data-driven recommendations customized to your needs.

Get in touch with us to schedule a consultation.