November 28, 2024

Lucy Farrand

Consulting Analyst

Yusef Rabiah

Consulting Analyst

1. What is sugar used for?

Everyone knows what sugar is, right? It’s eaten by virtually everyone on the planet.

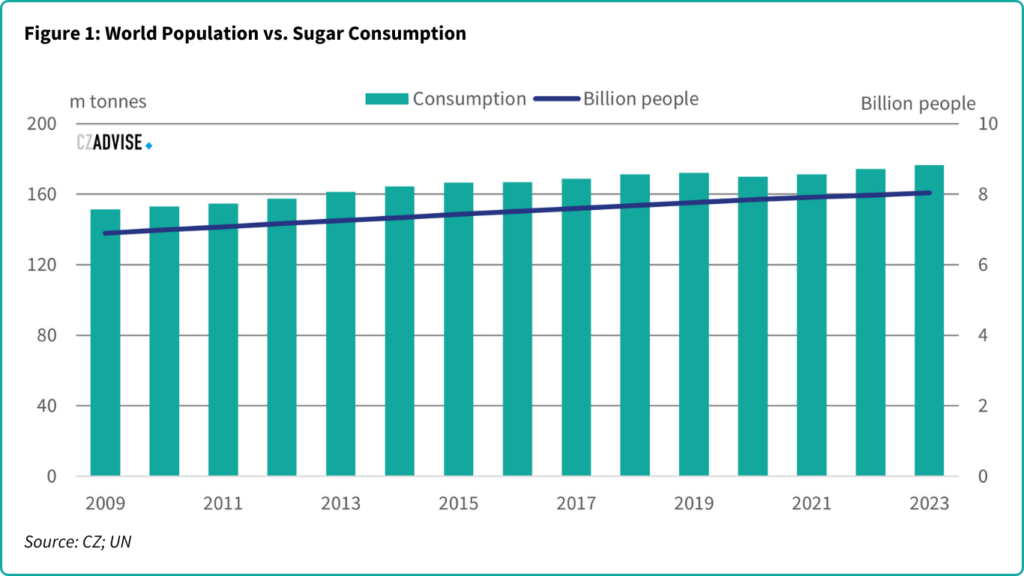

Its global consumption as a food therefore largely depends on population growth. More people means more sugar is consumed. How much each person consumes tends to depend on income.

At an extremely low level of income, people eat little sugar. But intake rises rapidly alongside income from a very low base. After all, sugar is a cheap luxury. It’s enjoyable to eat and provides cheap calories too. At high levels of income this trend frequently then reverses. There’s a limit to how much sugar we can eat each day and consumers are increasingly aware of the effects of sugar intake on health.

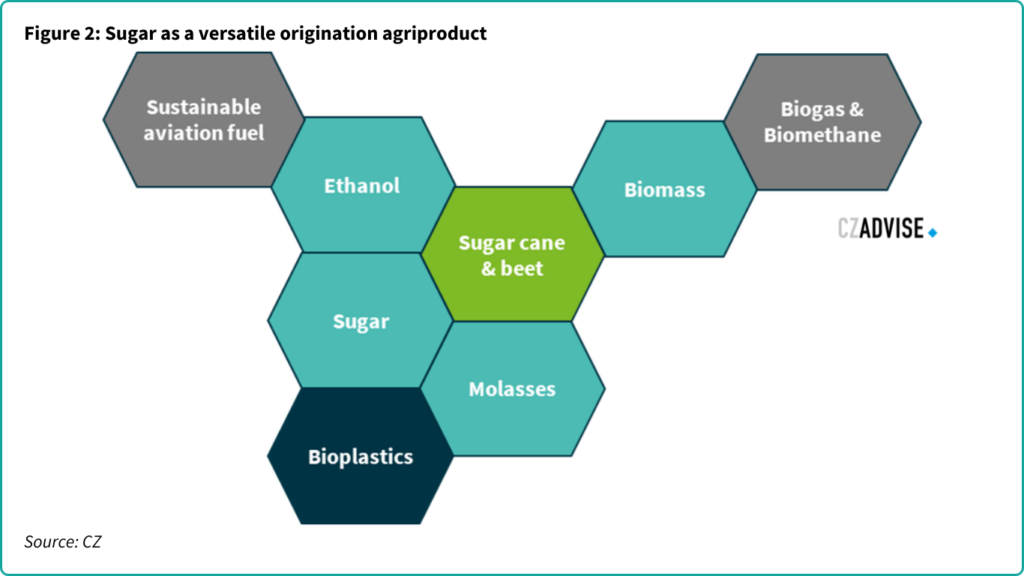

But sugar isn’t just a food. It’s made from plants (cane or beet) and so is increasingly being used as a source of renewable energy. It can be used as a feedstock for fermentation, which enables it to be transformed into ethanol for road transport, jet fuel or bioplastics like polylactic acid (PLA).

Several sugar groups are already investing in bioplastics production. For example, Balrampur Chini Mills Ltd, a major Indian sugar manufacturer, announced in 2024 that they would build a 75,000 tonne PLA plant at one of their existing cane mills. This is a major undertaking: they expect the project to cost INR 20b (USD 237m) and take 2.5 years to build.

Currently about 10-20% of the world’s PLA is produced from sugar, with the rest being derived from other feedstocks. This accounts for around 150 – 200k tonnes of sugar today; less than 0.5% of global sugar consumption. By 2027, an additional 150kt of sugar-based PLA capacity is set to be added, with more of these projects expected to be announced in the interim period.

But sugar for food is a relatively low-value product; it costs around USD 500/tonne today on the world market. It’s also a mature market with low annual growth rates. Bioplastics and renewable fuels offer sugar producers a chance to access higher-value rapidly growing markets. We therefore expect more cane and beet processors to follow Balrampur Chini Mills’ lead and to invest in diversifying their output in the future.

2. Where is sugar produced?

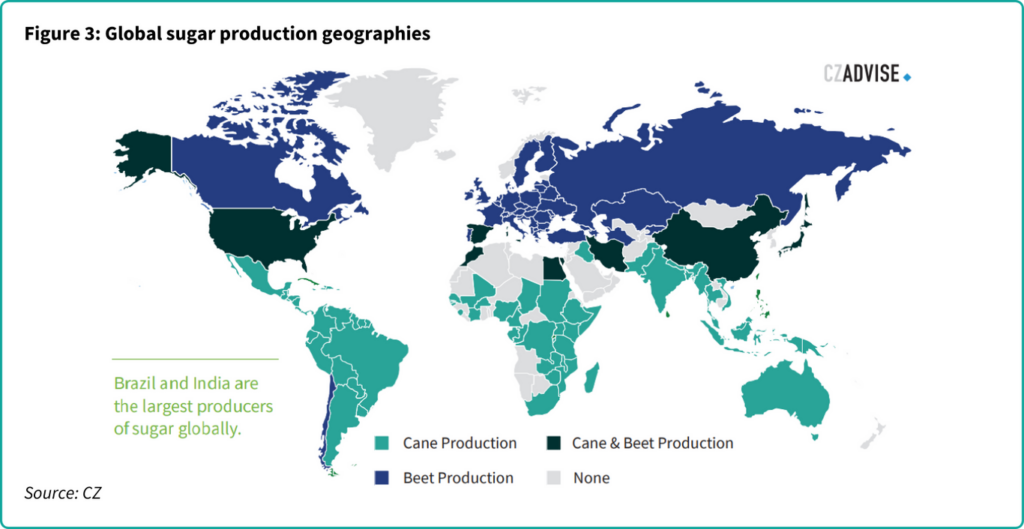

Sugar is extracted from either sugar beet or sugar cane.

Sugar cane is a type of grass; its main requirement is for plentiful water during its growth phase. It therefore tends to be grown in sub-topical and tropical areas with distinct wet and dry seasons. Sugar cane accounts for around 80% of the world’s sugar production.

Sugar beet grows best in temperate regions; the largest growers are the USA, Europe and Russia.

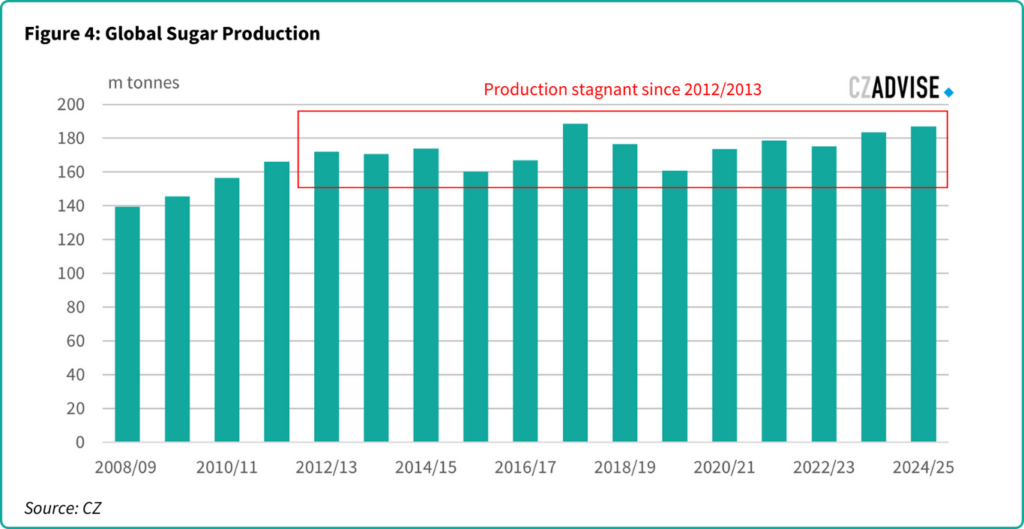

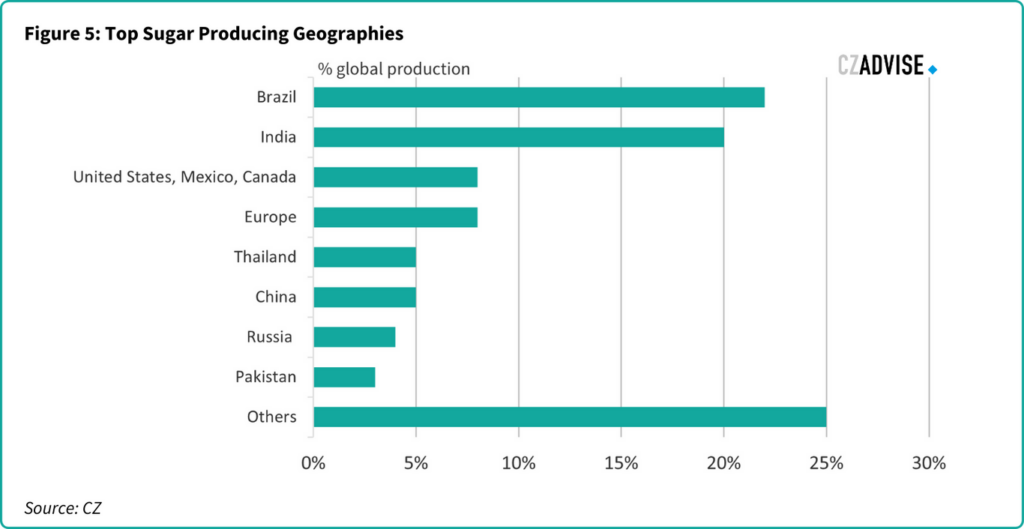

Global sugar production has been stagnant since 2012/2013 at around 175m tonnes a year, plus or minus 15m tonnes.

This is partly a result of a decade of low sugar prices in the 2010s, which discouraged investment in the sector. Recent rising sugar prices have led to new investments being made, but cane and beet are crops and so are vulnerable to adverse weather. The El Nino of 2023/24 was the 5th strongest in history and has slowed the output growth from recent investments.

Brazil is the largest sugar producer in the world and also by far the world’s largest exporter of sugar, accounting for as much as 75% of the world’s sugar trade. It therefore tends to dominate discussions around sugar availability and prices. Brazil’s sugar industry is also uniquely flexible. Many mills can choose to make sugar or ethanol for road fuel depending on which product offers the higher return.

India is the world’s other major sugar producer and is also the world’s largest sugar consumer. India is also on track to blend 20% ethanol into gasoline by 2025, with around half of this ethanol coming from sugar cane. India is therefore no longer a major sugar exporter.

The world’s largest sugar importers are China, Indonesia and the USA. The scale of Chinese and Indonesian demand means that much of the world’s sugar trade flows from west to east, transported by large ocean-going bulk vessels.

2.1 Global cost of sugar production

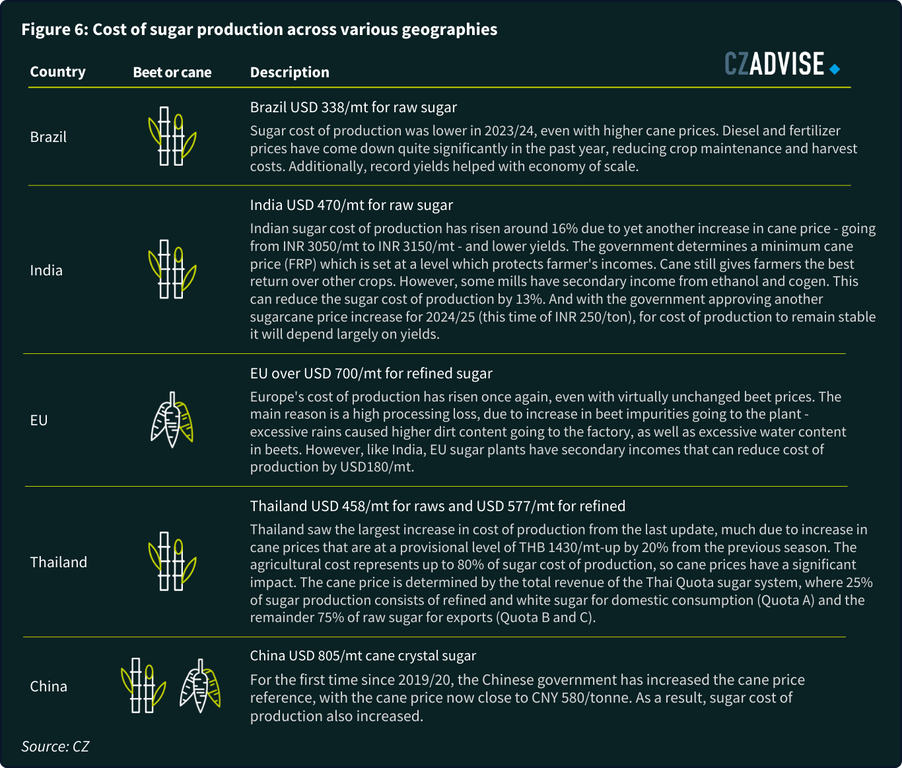

Sugar cane and beet are grown in more than 100 countries around the world. Sugar industries are often major rural employers. For this reason, many sugar markets around the world are heavily regulated and protected by governments. As a result, the amount it costs to make sugar varies widely too.

As well as regulations, the weather, local growing conditions, crop varieties and farming technology can all make producing sugar more or less expensive.

For example, Brazil is the world’s largest producers and exporters of sugar. It’s also one of the lowest-cost producers. We estimate cane mills in Brazil can make a tonne of raw sugar for around USD 338. This is considerably cheaper than other major raw sugar origins like Thailand (USD 458/tonne) and India (USD 470/tonne).

If bioplastic producers are seeking to vertically integrate with sugar mills so that they can access feedstock, the most viable locations are likely to be those with the lowest costs of sugar production. We are already seeing interest from the bioplastic sector in Brazil, India and Thailand.

Alternatively, bioplastics producers can seek to source sugar as a feedstock from the world sugar market. Of the 180m tonnes of sugar that’s made each year, around 50m tonnes is exported and traded on the world market. This sugar is traded according to international benchmark prices, quoted on futures markets in New York (raw sugar) and London (refined sugar). These markets are large and liquid and so present a transparent sourcing option.

2.2 Global sugar pricing

Raw sugar is the world’s most-traded sugar grade. This is an industrial product that requires further processing to be fit for human consumption. It can therefore be moved in bulk by road, rail or ocean-going vessel. White sugar and refined sugar are food-grade products that have stringent hygiene requirements and so must be handled accordingly.

Raw sugar is therefore typically cheaper than white or refined sugar and is most often used for fermentation.

Raw sugar prices are quoted in US c/lb, while white and refined sugar prices are quoted in USD/tonne. Raw sugar prices can be converted to USD/tonne by multiplying by 22.0462.

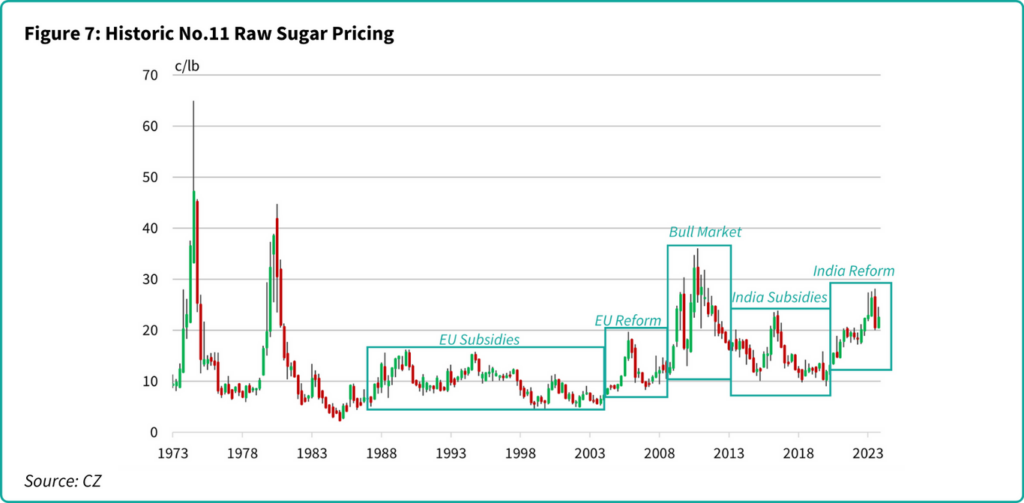

In general, as we move through time foods have become cheaper. This is because human ingenuity leads to better farming and crop technologies, increasing yields and reducing costs. Since the 1970s, raw sugar prices have largely traded below 20c/lb (with no adjustment for inflation), barring periodic episodes of supply shortages leading to price spikes.

Buyers can mitigate against price spikes by using futures markets to hedge their purchases, locking in tomorrow’s sugar at today’s prices. This helps buyers guarantee secure supplies at attractive prices. CZ Advise can help customers create a risk management plan to guide their hedging, alongside CZ’s derivatives team.

Corporate advisers in agricultural and energy production

CZ Advise provides tailored consulting and corporate finance for agri-business and bioenergy supply chains.

Our consulting teams operate globally and offer a wide range of strategic advisory services to help companies successfully navigate the bioenergy sector. We specialise in market scoping, offering insights into emerging trends and opportunities across regions, as well as detailed cost analysis to help clients optimise operational efficiency and profitability. Additionally, we provide feedstock availability assessments and feasibility studies, ensuring that projects are not only economically viable but also sustainable in the long term. Our expertise in risk management and international partnerships enables us to help clients mitigate uncertainties while expanding into new markets with confidence.

James Brittain

Director, Head of Advisory

CZ Advise is the largest agri-focused financial advisor in Brazil and Southeast Asia and has advised on over USD 5.4 billion in debt and equity transactions, assisting companies in securing the financial backing they need for growth and innovation. Our corporate finance expertise spans fundraising, capital structuring, mergers and acquisitions, and project financing, ensuring that our clients have access to the best possible funding solutions to scale their operations in a competitive global market.

Luis Felipe Trinidade

Associate Director, Global Head of Corporate Finance

CZ’s trading teams can assist with the procurement, shipment, and stock management of ethanol and biomass, ensuring reliable supply chains for our clients. We also support ongoing feedstock visibility and storage solutions, enhancing transparency across the supply chain and helping businesses stay resilient in the face of fluctuating market conditions.

Contact us

"*" indicates required fields